Calendar Spreads With Weekly Options

Calendar Spreads With Weekly Options – This means you must match your options trading strategy with the assets you’ve chosen. Traders can use calendar spreads that involve shorting the near date option contract and buying the long . On the other hand, due to high volatility, risk is also high. So we have created this Nifty Options Strategy for Election Result Week (Calendar spread) to limit our risk. Before deploying this .

Calendar Spreads With Weekly Options

Source : www.investopedia.com

Option expiry trading strategy (Double calendar spread) | no

Source : www.youtube.com

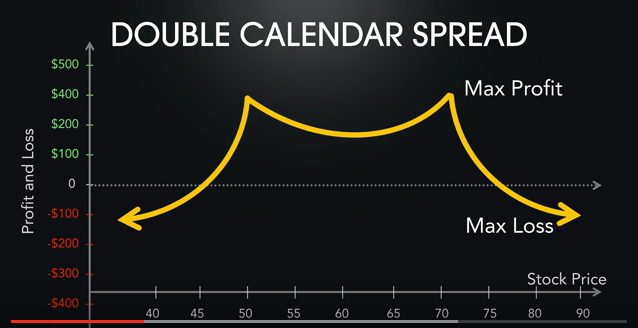

What are Calendar Spread and Double Calendar Spread Strategies

Source : www.myespresso.com

Calendar Spreads With Weekly Options

Source : optionstradingiq.com

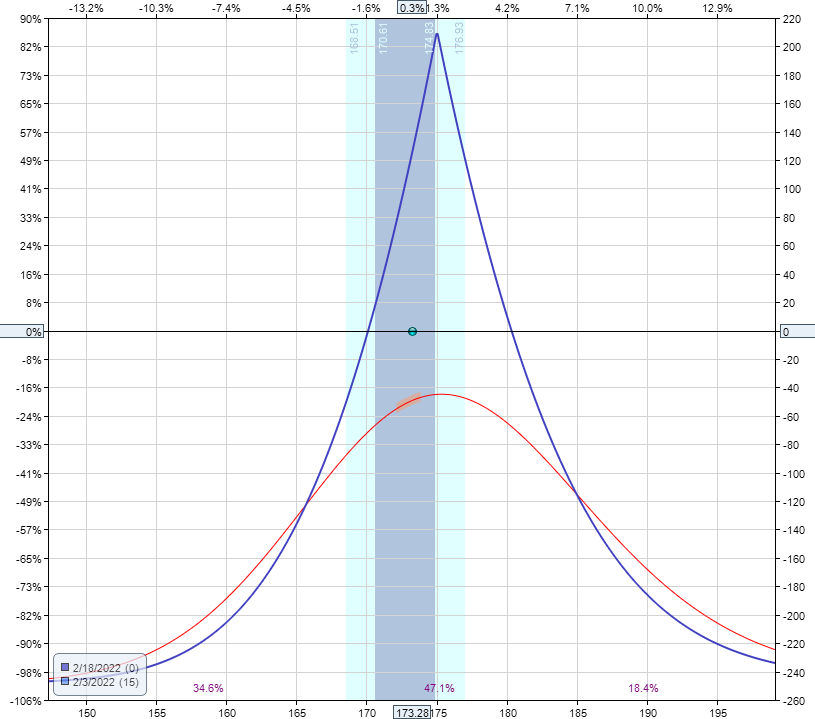

The Double Calendar Spread

Source : www.options-trading-mastery.com

Calendar Spreads | Weekly Option Selling Strategy | Theta Gainers

Source : www.youtube.com

Long Calendar Spreads Unofficed

Source : unofficed.com

Trading Calendar Spreads with Weekly Options Expirations

Source : www.vantagepointsoftware.com

Double Calendar Spreads : Ultimate Guide With Examples

Source : optionstradingiq.com

calendar spreads profit and loss

Source : www.theoptioncourse.com

Calendar Spreads With Weekly Options Calendar Spreads in Futures and Options Trading Explained: An early week decline in corn was followed by somewhat aggressive Broker with the Commodity Futures Trading Commission and an NFA Member. Futures and options trading involves substantial risk and . It’s a very quiet week on the earnings front it does serve as a reasonably accurate estimate. Option traders can use these expected moves to structure trades. Bearish traders can look at selling .

:max_bytes(150000):strip_icc()/calendarspread.asp_final-6628bf3928bd4717bde925a70b28ac8c.png)